The Oxstone Property Investment Report 2024 - Part 2: Leeds

- Rob Whitworth

- Mar 27, 2024

- 18 min read

T H E O X S T O N E P R O P E R T Y I N V E S T M E N T R E P O R T 2 0 2 4

P A R T 2 - L E E D S

Welcome to the second in our series of Property Investment Reports for 2024, where we explore the fundamentals and investment case for each of the UK cities which have made our investment shortlist for 2024. In our first Report of 2024, we provided an analysis of the investment case for Manchester, and you can read our report here.

In this second Report, we are focussing on Leeds - a city which, like Manchester, has had a consistent presence among the top destinations for buy-to-let investments in the UK in recent years.

We use eight objective criteria to assess the investment case for each of our featured cities:

Rental demand;

Rental price growth;

Rental yields;

Property prices;

Economic outlook;

Regeneration projects and investment schemes;

Connectivity; and

Amenities.

We hope you find our Property Investment Reports series interesting and informative. If you are interested in investing in Leeds, or any other town or city across the UK, please reach out to us for a discussion.

Introduction

We started our first Property Investment Report of 2024, focussed on Manchester, by outlining how 2023 had presented formidable challenges for the UK housing market. These challenges led to an increase in the number of people opting to continue to rent rather than to buy, which in turn increased demand on the rental sector and pushed demand, and rents up, while simultaneously applying a downward pressure on purchase prices.

The housing market in our chosen cities has nevertheless proven remarkably robust. It is our view that downward pressure on house prices, together with high rental demand, as well as reduced competition among landlords and record rental rates, could combine to make 2024 an excellent time to invest.

Factors placing downwards pressure on house prices | Factors placing upwards pressure on rents |

Material increases in mortgage rates since the start of 2022, decreasing affordability for purchasers. | Material increases in mortgage rates since the start of 2022, meaning landlords have increased rents to cover their costs. |

Conclusion of the Help to Buy Scheme, as more people look to renew leases rather than buy. | Conclusion of the Help to Buy Scheme, as more people look to renew leases rather than buy. |

Return to city-centre living following the end of the Covid-19 Pandemic. | |

Reduction in rental stock, caused by increased renewals and landlords exiting the market. | |

Increased net immigration to the UK. |

Leeds - Overview

£251,389 | 5.51% | £1,133 | 24% |

Avg. house price* | Avg. yield** | Avg. asking rent** | 5Y price growth**** |

Leeds, a former textile manufacturing powerhouse in West Yorkshire, now has one of the most diverse economies of all the UK's main employment centres and in 2016 was recognised for having the fastest rate of private-sector jobs growth of any UK city. Leeds is ranked as a 'Gamma World City' by the Globalization and World Cities Research Network, classifying it as a major city with a key role in linking the wider region to the world economy. Leeds is considered the cultural, financial and commercial heart of the West Yorkshire Urban Area, and after London, is the largest legal and financial centre in the UK, with more than 30 national and international banks located in the city. It is also the UK's third largest manufacturing centre. Beyond legal and finance, Leeds has strengths in engineering, printing and publishing, food and drink, chemicals and medical technology. Companies with more than 1,000 employees based in Leeds include Asda Group, First Direct, Centrica, Ventura, BT, Direct Line Group and Yorkshire Bank.

With the UK's fourth largest urban economy, there is a wide variety of tenants looking for long-let investment property to rent in Leeds. With four universities and the fourth largest student population in the country, demand for rental accommodation at both the undergraduate and post-graduate levels is high.

Leeds is also currently the second most active city in the built-to-rent market, after Birmingham. Investment in BTR in Leeds has increased in recent years, nearing £350m in 2023 – up 78% on 2022. Although the operational stock in Leeds (3,400 homes) remains a fraction of Manchester’s (11,400), it is catching up, with nearly 8,200 homes in its pipeline.

Increasingly diverse, the vibrant Leeds City Region is the UK’s largest regional financial and business centre outside of London. Alongside the wider Yorkshire market, the region is home to many UK leading professional services, major logistics hubs as well as a rapidly growing digital industry. The region offers exceptional investment opportunities, development potential and business growth.

Criteria 1: Rental Demand

8% | -13% | 55,600 | 27%+ |

Population growth since 2011 | Rental stock versus 2019 | Graduates per annum | Graduate retention rate |

Each of the cities in our 2024 shortlist is experiencing substantial rental demand. Leeds has seen comparable population growth to Manchester - between the last two censuses (held in 2011 and 2021), the population of Leeds increased by 8%, from around 751,500 in 2011 to around 812,000 in 2021. This compares to population growth of 9.7% in Manchester. This figure is materially higher than the overall increase for England, which stands at 6.6%.

Despite the increasing population of the city, the supply of housing in Leeds has struggled to keep up with demand, which has contributed to a shortage of available housing options. This has in turn led to increased competition, particularly in the rental market, resulting in rapidly rising rents – a pattern seen across many areas of the UK.

Hop Property, a local lettings agent, recently published an article in the Yorkshire Post stating that the rentals market in Leeds has remained very busy in the 12 months to January 2024, with rents in many areas increased by between 10 per cent and 12 per cent in 2023. They report receiving between 25 and 30 enquiries for every property they list, describing the market as 'very competitive' for tenants. According to the latest census data, private renters make up 21.8% of all households in Leeds.

“Despite seeing a significant increase in both population size and inward investment, Leeds has not yet been able to deliver enough housing to satiate this growing demand. It has many of the same characteristics that have made neighbouring Manchester so successful, but this potential is not yet being fully harnessed so it is crucial that this supply is increased to continue to attract people to the region and provide them with good quality homes close to major employment opportunities.”

Louise Emmott, managing director at property developer Kingsdene

The working population of Leeds is expected by some to rise more modestly than other cities, at around 2% between 2022 and 2032, though CBRE has predicted that Leeds will have the highest growth of disposable income of any major UK city over the next decade, of 21.7%.

Like Manchester, Leeds is host to multiple universities and educational establishments, including the University of Leeds, Leeds Beckett University, Leeds Trinity University and Leeds Arts University. Demand for rental property is supported by Leeds' student and graduate population. Over 70,000 students call Leeds home, the fourth largest student population in the UK. The city currently retains the fifth-highest number of graduates, ahead of Bristol, Cambridge and Oxford, with 27% of the 55,600 students that graduate from the universities across Leeds each year electing to remain in the city post-graduation. While this compares less favourably to Manchester, where over half of students remaining in the city post-graduation, this nevertheless amounts to approximately 12,500 students being retained each year in the city.

Criteria 2: Rental Price Growth

28.7% | £850 | £1,250 | £1,850 |

Rental growth since 2020 | 1 bed average rent per month | 2 bed average rent per month | 3 bed average rent per month |

Leeds recorded its fourth consecutive year of rental price growth during 2023, with rental grwoth slowing slightly to 3.9% in the last 12 months, after three years of strong growth. Rental prices within Leeds are now approximately 29% higher than in 2020, according to JLL. Average rents for a new one bed flat in the city are currently circa £843pcm, £1,147 pcm for a two bed flat and £1,444 pcm for a three-bed^, though other sources put the averages even higher, around £850, £1,250 and £1,850 respectively.

Rental price growth is expected to main consistently strong in the coming years, a consequence of Leeds' strong economy and the current dearth of housing supply. The latest data from the ONS recorded average rents in England rising by 6% year on year, the highest on record, and CBRE expects a similar rate of growth to persist in 2024, with the build-to-rent sector likely outperforming the broader headline level of growth.

There is growing alignment in the market that rental price growth will begin to slow in 2024 as rental affordability decreases. Rightmove has predicted that rents outside of London generally will be 5% higher than in 2023.

Looking ahead to 2024, the shortage of available rental property looks set to be an ongoing theme. As a result, we expect rents to rise further, although possibly at a slightly slower pace than in 2023, but growth of between eight and ten per cent would come as no surprise.

Luke Gidney, Managing Director, Hop Property

^Data from propertydata.co.uk based on near real-time property listings seen on rightmove.co.uk, zoopla.co.uk and onthemarket.com. Valid as at 22 March 2023.

Criteria 3: Rental Yields

6.7% | 8.8% | 7.6% | 12.0% |

Average yield, LS1 | Average yield, LS2 | Average yield, LS6 | Average yield, LS3** |

Leeds tends to perform strongly from a gross rental yield perspective, driven by the relationship between strong rental growth and relatively affordable house prices, as well as a buoyant student population (rental yields in student HMOs tend to be higher than traditional buy-to-let properties). Gross rental yields for traditional buy-to-let properties of between 5% and 7% in Leeds are typical. Propertydata.co.uk's data suggests average rental yields across Leeds' twenty-nine postcodes is 5.51%. This compares favourably with the national average yield for UK rental property, which is estimated to be approximately 4.75%.

Rental yields are strongest in the LS3 postcode of Burley, which is home to some of the most affordable housing in Leeds, and also a large student population. Properties here are generally cheaper than in the city centre and are often let as homes of multiple occupation, resulting in high rental yields. Within the city centre postcodes of LS1 and LS2, the average yield is c. 7.75%, according to propertydata.co.uk. Across the residential areas of LS5 (Kirkstall), LS6 (Hyde Park), LS7 (Chapel Allerton) and LS8 (Roundhay) the average is 5.35%. Coupled with expected capital growth in property values, this presents a potentially attractive return for investors.

More broadly, recent market uncertainty as regards house prices, coupled with rental price growth, presents opportunities to achieve strong gross yields in various areas of the city.

"Leeds has enjoyed a sustained period of growth across both the sales and lettings markets for the last few years, as greater investment in the city centre has fuelled increased migration of professionals and students. Although the rate of growth has slowed, we're continuing to see demand from these groups so we anticipate that higher value growth is on the horizon unless the dearth of supply of suitable homes can be addressed."

Tom McWilliams, head of Yorkshire and North East and regional development at JLL

Criteria 4: Property Prices

£251,389 | 24% | 48% | 1% |

Average house price* | Mean 5-year capital appreciation, across 29 Leeds postcodes | 5-year capital appreciation, LS1 | 12-month capital appreciation, central Leeds |

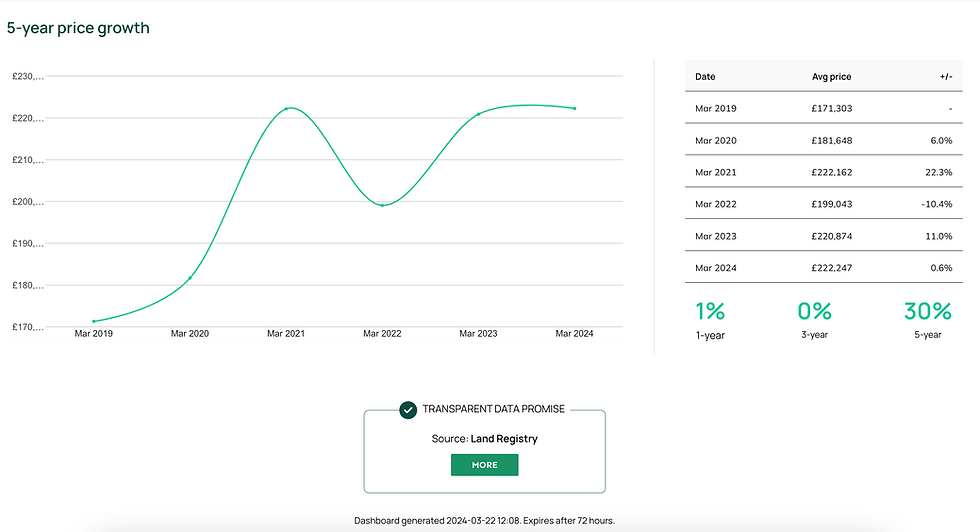

Leeds is consistently ranked as one of the top five cities in the UK for capital growth. Analysis of sold-price data from the UK Land Registry indicates that the five-year growth curve for house prices in central Leeds is +30% positive, and that housing in central Leeds has continued to appreciate in value, even in the face of market headwinds over the last 12 months, as shown in diagram below. Local lettings agents Hop Property are predicting five-year house price growth of 14% within Leeds between 2023 and 2027.

Average house prices in Leeds are comparable to those in Manchester (£250,318), Newcastle (£259,588) and Birmingham (£250,574), and exceed those of other northern cities, including Liverpool (£203,972) and Glasgow (£231,958). Leeds' prices nevertheless remain highly competitive when compared to Edinburgh (£346,838) and southern cities such as London (£736,270), Bristol (£392,651) and Brighton (£759,951).*

Further, despite the challenges posed to the wider property market in the UK, new development house prices in Leeds over the last 12 months have on average bucked the trend. Average annual new build house price growth was 1.4% the year to August 2023. This average is dragged down by a sharp fall of -3.2% in the value of 1 bedroom flats, for which there has been less demand, potentially partially a consequence of the increased popularity of second bedrooms acting as home offices for remote workers and increases in the numbers of people preferring to share accommodation in light of cost of living pressures. The price of 2 bedroom flats increased 2.2%, three bedroom flats increased 2.9% and prime new builds increased 7.3%, due in part to a new wave of higher specification homes reaching the market. Demand for modern, energy efficient homes has risen significantly since the start of the war in Ukraine and the increase in the cost of energy thereafter.

*Source: Zoopla, based on sold prices for the last 12 months.

Criteria 5: Economic outlook

Leeds has now firmly cemented its reputation as the UK’s second city for finance and legal services, with over 352,000 people employed in these sectors across the city, and financial and business services accounting for 38% of total output. Each of the UK’s big four accountancy firms (PwC, KPMG, Deloitte, EY) have a strong presence in Leeds, which is also home to three of the UK’s top five building societies. The city is supported by a strong legal sector, with 1,560 legal companies based in the wider region, including 28 of the UK’s top 100 law firms. Other key sectors include retail, leisure and the visitor economy, construction, manufacturing and the creative and digital industries.

Leeds is home to a raft of national and multinational companies, including ASDA Group, Nestlé, Hiscox, Centrica, Ventura, BT, Direct Line Group, Channel 4, DAZN, First Direct, Lloyds Bank, ReedSmith, Morrisons, Sky and Burberry. Over 32,000 VAT-registered businesses are based in Leeds and more than 6,000 small and medium-size enterprises, which account for more than half of employment. The number of mid-size and large companies and organisations based in Leeds is significantly above the national average.

The city also has a growing digital / tech reputation, across sectors including data analysis, software development, digital health, gaming and fintech, and is home to over 8,695 digital tech businesses employing over 53,000 people. Leeds also plays host to the largest digital festival in the North and second largest tech festival in the UK – The Leeds Digital Festival. According to new data on business 'scale-ups' – companies which have achieved three years of 20% growth in revenues or employees – Leeds is one of the UK’s foremost centres for fast growing firms, behind only London and Cambridge.

According to Leeds City Council, Leeds’ economy is forecast to grow by 21% over the next ten years, with financial and business services set to generate over half of GVA growth over that period. Further, EY’s latest Regional Economic Forecast has predicted that Leeds’ economy will grow by 1.9% per year on average over the course of 2024 to 2027, when measured by Gross Value Added (GVA), in line with the UK’s predicted growth as a whole. This reflects a strong economic performance when compared with the predicted GVA performance of other cities across the UK, outpacing Edinburgh, Cambridge, Sheffield, Birmingham, Nottingham, Cardiff, Glasgow and Liverpool. EY has projected that Leeds will add £1.5bn to its economy by 2026, compared with 2022, bolstered by the city’s employment growth, which is expected to be 1.2% per year on average from 2024 to 2027 – marginally faster than the national (1.1%) rate.

According to EY, Leeds’ GVA performance was relatively strong in 2023, at 0.8%, outpacing Liverpool, Bristol and Edinburgh (all 0%), London (0.6%), Newcastle (0.7%) and Reading (0.7%). By contrast, Birmingham (-0.8%), Nottingham (-0.6%) and Cambridge (-0.3%) all saw negative GVA growth. The UK as a whole recorded 0.3% GVA growth. Only Glasgow (0.9%), Cardiff (1.6%) and Manchester (2.2%) recorded higher GVA growth in 2023 than Leeds. Leeds is expected to see consistent GVA growth in 2024 of 0.9%, but notably continues to lag behind its main Northern rival, Manchester, which EY predicts will achieve GVA growth of 1.8%.

EY’s report recognises that levels of disposable income per capita in Leeds are the highest of any Northern city (other than Edinburgh), including Manchester, Birmingham and Nottingham, and CBRE noted in their 2023 ‘Which City? Which Sector?’ Report that “Leeds scored particularly high on forecasted growth of disposable incomes”. CBRE has predicted that Leeds will have the highest growth of disposable income of any major UK city over the next decade, of 21.7%.

According to Oxford Economics, of the top 10 ranked UK growth cities, Leeds has the fourth highest forecasted growth in office-based employment over the next 10 years (11%), behind Manchester (13.5%), Bristol (13%) and Birmingham (13%). Leeds has the sixth-highest amount of pipeline office development space currently under construction.

“The North is home to fantastic towns and cities, along with ambitious businesses and an abundance of talent... the region will be well-placed to feel and contribute to the benefits of the UK’s return to economic growth over the next few years. Major cities including Newcastle, Leeds and Liverpool are once again expected to be a driving force for economic growth in the North and across the UK. Meanwhile, Manchester is poised to maintain its status as an economic powerhouse, fuelled in part by its flourishing tech sector.”

Stephen Church, EY’s North Market Leader.

Criteria 6: Regeneration projects and investment schemes

Leeds is undergoing significant transformation through various investment projects and regeneration schemes which are aimed at revitalising different areas of the city, enhancing its transport network, and fostering economic growth.

On 6 March 2024, the UK government outlined comprehensive plans for the regeneration and development of Leeds, with a vision spanning the next decade. These plans can be read in full here. In its paper, entitled, “A vision for Leeds: a decade of city centre growth and wider prosperity”, the Government expressed its intention to “supercharge development in Leeds as part of the most ambitious urban regeneration programme in this country for decades.”

The plans focus specifically on matters which have held Leeds back, including relatively poor transport connectivity, the resolving of which could unlock a further £3bn for the UK economy each year. Included within the Government’s plans are:

Neighbourhood Revitalization: The Government aims to revitalise six associated neighbourhoods – Mabgate, Eastside & Hunslet Riverside, South Bank, Holbeck, West End Riverside, and the Innovation Arc – by unlocking and supporting the delivery of 20,000 new homes to meet demand. This effort is intended to create new, vibrant neighbourhoods while bringing investment benefits to existing communities.

Improved Connectivity: The UK Government’s paper recognises that Leeds is the biggest city in Western Europe without a light-rail or metro-style system. The Government is focussed on enhancing Leeds’ city and regional connectivity through an improved public transport system as a priority, to spur broader regeneration efforts. This includes the allocation of £2.5bn of funds previously committed to HS2, to fund the development of the West Yorkshire Mass Transit System, rail electrification, and station upgrades.

Sectoral Strengthening: There will be a focus on strengthening anchor institutions and key sectors, especially digital, healthcare, and medical technology, aligning with the Leeds Inclusive Growth Strategy to create inclusive economic growth.

Further Government Funding: The UK government has already awarded over £80 million in Levelling Up funding since 2019 and secured significant investment through the West Yorkshire Devolution Deal and the West Yorkshire Transport Fund. Additional funding will be allocated for various projects, including the transport system upgrades.

Investment Zone: West Yorkshire has been designated a specific Investment Zone, with the intention to drive innovation and growth in HealthTech and digital sectors, with infrastructure investments expected to generate thousands of jobs and significant investment over the next decade.

Cultural Projects: The government is also supporting cultural projects such as the potential British Library North, the National Poetry Centre, and the expansion of facilities like the Royal Armouries to enhance Leeds' cultural landscape and community involvement.

Overall, the Government states that its aim is to accelerate Leeds' growth as a greener, healthier, and economically vibrant city, with a focus on inclusive development, improved connectivity, sectoral growth, and cultural enrichment. Visionary and holistic planning involving local stakeholders, investors, and professionals aims to ensure sustainable development that respects the city's assets, including rivers and canals, and adapts the historic environment to support investment and local preferences.

Specific, ongoing major investment schemes within Leeds include:

The South Bank Regeneration: Covering an area equivalent to 350 football pitches, the project is one of the largest regeneration projects ever undertaken in the UK. With £500m public investment and billions of pounds of private investment it has garnered considerable national and international backing. Leeds City Council’s overarching vision is to turn South Bank into a "distinctive European destination for investment, living, learning, creativity and leisure". South Bank Leeds aims to double the size of Leeds city centre by transforming the ex-industrial area south of the River Aire. The historic area, echoing the city's industrial past, will be revitalised for living, learning, creativity, leisure, and investment. The project is expected to create 8,000 new homes and 35,000 jobs, further enhancing Leeds' appeal as one of the UK's most desirable cities.

Holbeck Urban Village: The Holbeck Urban Village initiative seeks to reconnect historic suburbs with Leeds City Centre, breathing new life into the area's industrial heritage. The project involves repurposing old industrial buildings into modern residential, commercial, and cultural spaces, fostering a sense of community and revitalising the urban landscape.

Leeds Station Redevelopment: Leeds Station, a pivotal transport hub and one of the busiest rail stations in the UK, is undergoing redevelopment to accommodate growing passenger numbers and improve connectivity, with the government recently announcing a further £280 million investment. Plans include modernizing platforms, enhancing accessibility, and integrating retail and commercial spaces, ensuring the station remains a vital hub for commuters and visitors alike.

Leeds Bradford Airport Expansion: Plans for the £100 million expansion of Leeds Bradford Airport aim to increase capacity and improve facilities, supporting economic growth and improving regional connectivity. The project includes the construction of a new terminal building, runway extensions, and upgraded transport links, catering to the growing demand for air travel. By 2030, it is claimed that the regeneration has the potential to create 1,500 new direct jobs at LBA and 4,000 new indirect jobs, as well as contribute a total of £940 million to the local economy.

City Square Redevelopment: Plans to pedestrianise City Square seek to transform it into a vibrant public space, reducing traffic congestion and providing an enhanced environment for pedestrians and cyclists. This redevelopment underscores Leeds' commitment to creating welcoming and accessible urban spaces for residents and visitors.

Criteria 7: Connectivity

Leeds is generally well connected to the rest of the UK and the continent through its road, rail and air transport links.

By Train: Leeds benefits from extensive national rail connections, serving as a key railway hub in the North of England. The city's main railway station, Leeds Station, offers frequent direct services to major cities such as London (2 hours 15 mins), Manchester (45 mins), and Birmingham (1 hour 30), as well as regional destinations within Yorkshire and beyond. Above-mentioned recent investments, including electrification and upgrades to the regional railway lines, are underway with the aim to improve service reliability, increase capacity, and reduce journey times, enhancing the overall rail connectivity for commuters and travelers. The Transpennine Route Upgrade aims to substantially improve reliability, capacity, and journey times across Manchester, Leeds and York, and the direct investment in the West Yorkshire Mass Transit system will make it easier for people to move around the region, improving access to jobs, retail and leisure opportunities, boosting the economy and supporting productivity.

By Road: Leeds enjoys robust connectivity by road, with major motorways including the M1 and M62 passing near to the city. Additionally, ongoing improvements in road infrastructure, such as the Leeds Inner Ring Road and the East Leeds Orbital Road, aim to alleviate congestion and enhance connectivity within the city. The road network serves as a vital link for commuters, businesses, and freight transport, contributing to Leeds' position as a regional economic hub.

By Air: Leeds Bradford Airport is located approximately 7 miles northwest of the city centre. TheAirport offers domestic and international flights to various destinations, serving both leisure and business travelers. As mentioned above, the airport is currently undergoing a £100m upgrade.

Criteria 8: Amenities

Leeds and the wider Yorkshire area offer a diverse range of amenities, from world-class arts and culture to stunning natural landscapes, vibrant nightlife, strong dining options, and top-tier sporting events, adding to the city's appeal as a place to live and invest.

Arts & Culture: Leeds boasts a vibrant arts and culture scene, with numerous galleries, museums, and theatres enriching the city's cultural landscape. The Leeds Art Gallery showcases an impressive collection of British and European art, including works by renowned artists such as Henry Moore and Barbara Hepworth. The Yorkshire Sculpture Park, located a short drive from Leeds, offers a unique outdoor experience with sculptures set amidst picturesque parkland and the Royal Armouries Museum is highly regarded.

The city is also home to a thriving theatre scene, with venues like the West Yorkshire Playhouse and the Leeds Grand Theatre hosting a diverse range of productions, from classic plays to contemporary performances. For music enthusiasts, Leeds offers a bustling live music scene, with venues like the Brudenell Social Club and Leeds Arena attracting both local talent and international acts.

Nature: Leeds serves as a gateway to the stunning natural landscapes of Yorkshire. Within easy reach of the city, the Yorkshire Dales offer breath-taking scenery, with rolling hills, picturesque villages, and cascading waterfalls waiting to be explored. Outdoor enthusiasts can enjoy a variety of activities such as hiking, cycling, and birdwatching.

In addition to the Yorkshire Dales, Leeds is also in close proximity to the picturesque Yorkshire Moors and the Peak District National Park, offering further opportunities for outdoor adventures and nature exploration.

Nightlife: Leeds boasts a dynamic nightlife scene, with a wide array of bars, pubs, clubs, and live music venues catering to every taste. The city's vibrant nightlife district, centred around Call Lane and Greek Street, comes alive after dark with bustling bars and lively clubs, offering everything from craft cocktails to live DJ sets.

For those seeking a more laid-back atmosphere, Leeds also offers cozy pubs and stylish cocktail bars scattered throughout the city. Trendy rooftop bars offer panoramic views of the city skyline and historic alehouses serve up traditional Yorkshire brews.

Restaurants and Cafés: Leeds is a food lover's paradise, with a diverse culinary scene that reflects the city's multicultural influences. From Michelin-starred fine dining establishments to quirky independent cafés, Leeds offers a plethora of dining options.

The city's dining scene showcases a range of cuisines, from traditional Yorkshire fare to global flavours. The city's bustling food markets, such as Kirkgate Market and Trinity Kitchen, offer a vibrant culinary experience, with a wide selection of street food stalls.

Sport: Leeds is a sporting hotspot, with a rich sporting heritage and a passionate fan base supporting a variety of sports teams and events. Headingley Stadium, located in the Headingley district of Leeds, is home to both the Leeds Rhinos rugby league team and the Yorkshire County Cricket Club, making it a hub for sporting action year-round. Headingley plays host to international cricket, T20 and The Hundred. Elland Road is home to Leeds United Football Club, one of the most famous football teams in the UK with a passionate and large fan base. Leeds is home to a range of other sports facilities and clubs, including tennis and golf, as well as a range of fitness centres and gyms catering to every budget.

Summary

Leeds has secured its place on our shortlist of the best UK cities in which to invest in 2024 due to its strong performance in each of our objective investment criteria. The city has a strong rental demand and rental price growth, fulled by an undersupply of housing despite sustained long-term population growth. The city also has relatively affordable housing and strong economic fundamentals and amenities. It is also attracting substantial investment in the build-to-rent sector and via its numerous ongoing regeneration projects, and while the inter-city and regional transport links require improvement, it is clear that this is now a focus of central government attention and investment.

If you are interested in potentially investing in Leeds, or any other location across the UK, reach out to us for a discussion.

About Oxstone

Oxstone is a market-leading UK property sourcing company and purchaser's agency. We leverage the latest AI-enabled property sourcing and investment analysis software and our strong network of connections across the UK to source, analyse and secure excellent residential and investment properties for our clients, including off-market properties that are not available to the general public.

We also offer our clients deep market expertise, superior transaction management throughout the buying process and connections to recommended service providers. Our expert guidance through each step of the buying process ensures our clients are among the best placed in the market to succeed in their relocations or investments.

Additional sources and references

*Source: Zoopla, average sold price in last 12 months.

**Source: PropertyData.co.uk, across 29 Leeds postcodes

***Source: propertydata.co.uk, across 29 Leeds postcodes

****Source: propertydata.co.uk, across 29 Leeds postcodes

Commentaires